A well-planned budget is the foundation of every successful financial strategy. Yet, many people view budgeting as restrictive or stressful. In reality, a budget is your financial map — it shows you where your money is going and helps you take control instead of living paycheck to paycheck. Let’s explore how to create a simple, stress-free budget that truly works.

1. Why You Need a Budget

Without a plan, it’s easy to overspend and struggle with savings. Budgeting helps you:

- Track where your money goes each month

- Avoid unnecessary expenses

- Build savings for future goals

- Achieve financial stability and peace of mind

Think of it as a financial GPS — guiding your money in the right direction.

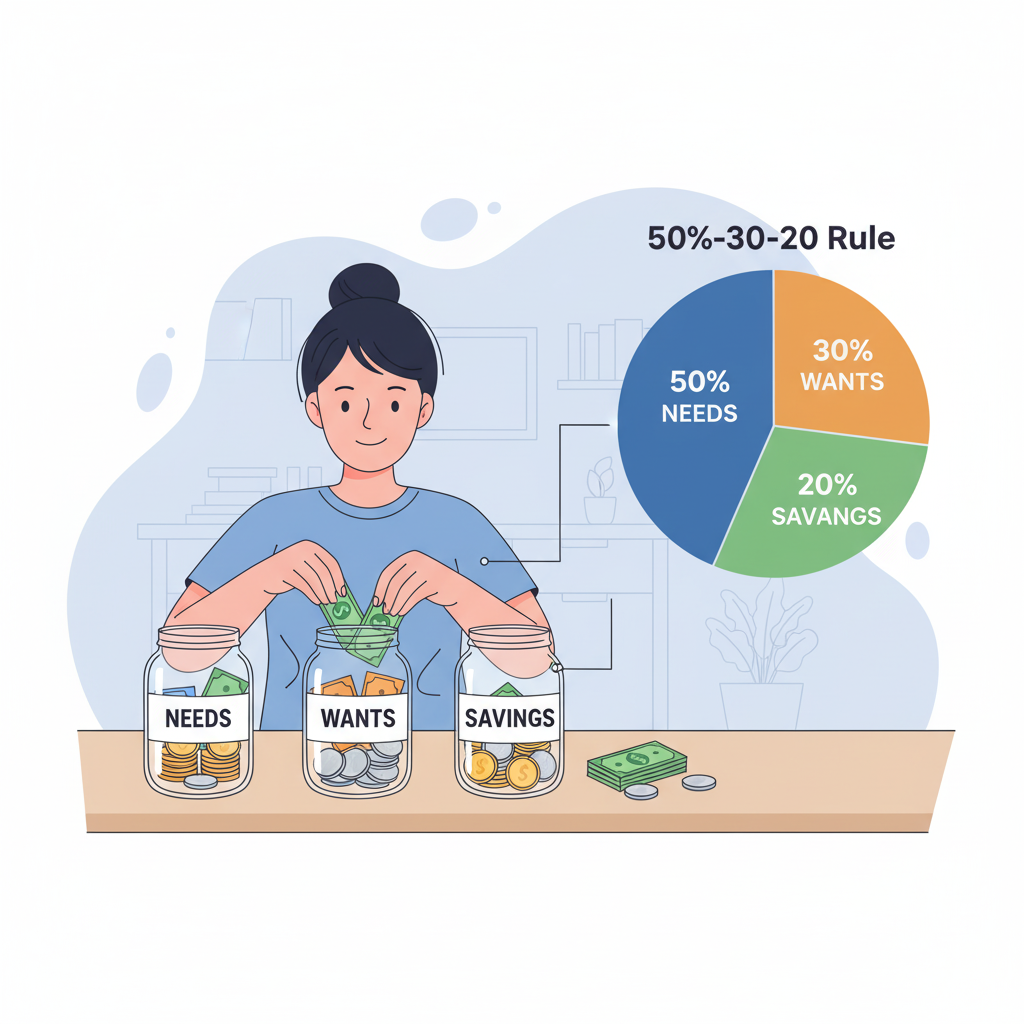

2. The 50-30-20 Rule: A Proven Formula

The 50-30-20 rule is a simple and effective framework for modern budgeting:

- 50% Needs: Rent, groceries, transportation, utilities, healthcare.

- 30% Wants: Dining out, entertainment, subscriptions, travel.

- 20% Savings/Investments: Emergency fund, SIPs, or debt payments.

This balanced approach allows you to enjoy life while staying financially responsible.

3. Track Every Expense

Awareness is key to control. Use budgeting apps like Walnut, Money Manager, or Excel Sheets to record your daily expenses. Seeing your spending patterns helps identify leaks — those small, unnoticed expenses that add up over time.

Pro Tip 💡: Review your monthly spending every weekend to stay on track.

4. Prioritize Saving Before Spending

Follow the “Pay Yourself First” principle — set aside savings as soon as you receive your income. Automate transfers to your investment or savings account. This ensures you build wealth before expenses eat into your paycheck.

5. Adjust, Don’t Restrict

Budgets shouldn’t feel suffocating. Allow flexibility for unexpected costs or leisure spending. If one category overshoots, adjust another — the goal is balance, not perfection.

6. Review and Improve Monthly

A budget is not static — review it regularly. Adjust goals as your income or lifestyle changes. Over time, you’ll notice patterns and opportunities to save more effectively.

💡 Conclusion

Budgeting isn’t about cutting joy; it’s about gaining control. By applying simple rules, tracking expenses, and saving first, you can create a stress-free financial plan that supports both your goals and lifestyle. Start today — because small changes in spending can lead to big changes in life.