Most people create a budget once and then forget about it. The real secret to financial success is building a simple, realistic monthly budget that you can actually follow every day. A good budget doesn’t restrict your life — it gives you clarity and control.

This step-by-step guide will help you design a monthly budget that fits your lifestyle and financial goals in 2025.

Step 1: Calculate Your Monthly Income

Start by listing all sources of income:

- Salary (after tax)

- Freelance or side income

- Rental or interest income

💡 Use your net income, not gross — this keeps your budget realistic.

Step 2: List All Fixed Expenses

These are unavoidable costs you pay every month:

- Rent or home loan EMI

- Electricity, internet, phone bills

- Insurance premiums

- School fees

These expenses should be prioritized first.

Step 3: Track Variable Expenses

Variable expenses change monthly:

- Groceries

- Transport

- Eating out

- Shopping

Track these for at least one month to find your average spending.

Step 4: Decide Your Savings Target

Before spending on wants, fix your savings amount.

Aim for at least 20% of your income toward:

- Emergency fund

- SIPs / investments

- Retirement savings

💡 Treat savings like a compulsory bill you must pay yourself.

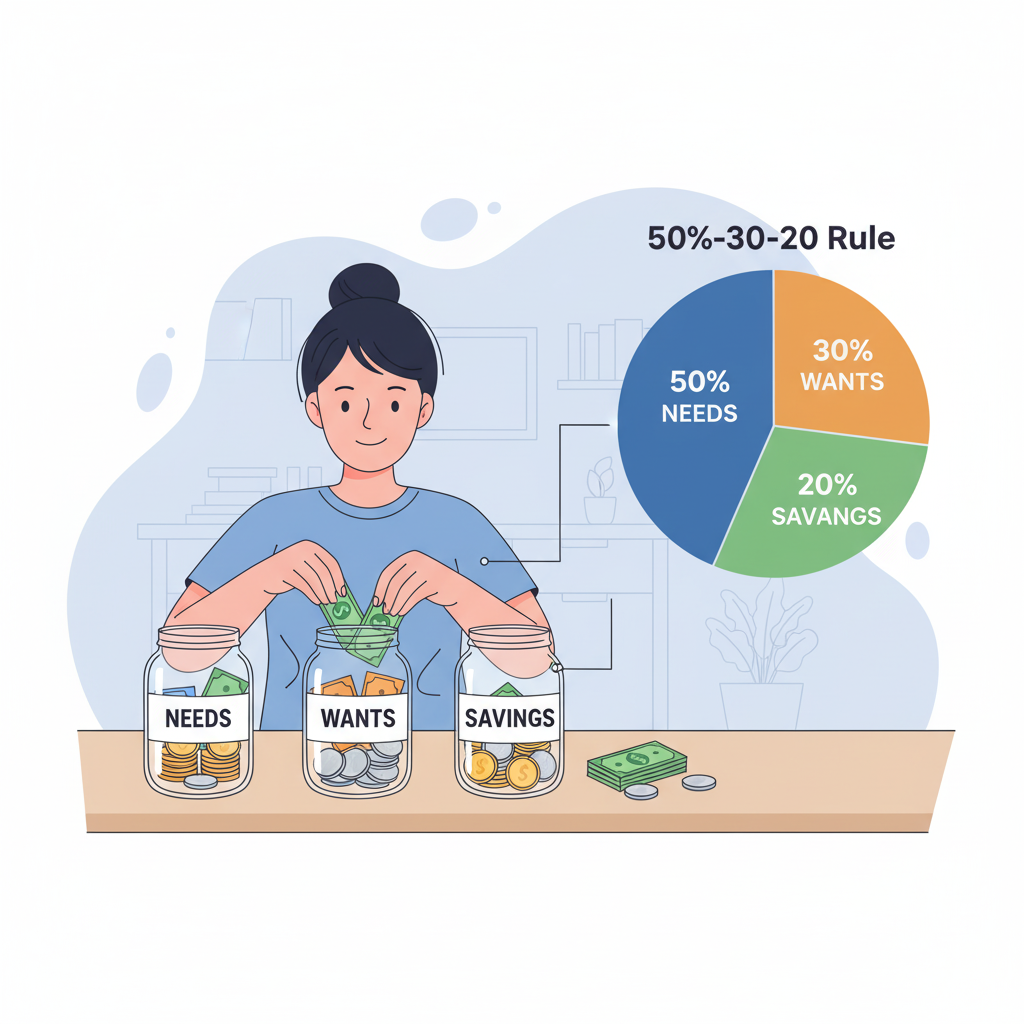

Step 5: Use a Simple Budget Formula

Apply the 50–30–20 rule:

- 50% → Needs

- 30% → Wants

- 20% → Savings & investments

Adjust this based on your lifestyle — the key is balance.

Step 6: Review Weekly, Improve Monthly

Check your budget every week for overspending.

At month-end, analyze what worked and what didn’t — then improve next month.

Consistency beats perfection.

💡 Conclusion

A working monthly budget is your personal financial GPS. It tells you where your money is going and guides you toward your goals. Start simple, stay honest, and keep refining — within a few months, budgeting will feel natural and empowering.