Creating a monthly budget is one of the smartest financial habits you can adopt — but making it work is where most people struggle. Many start with good intentions, only to give up halfway through the month. A successful budget isn’t about restriction; it’s about building a system that fits your life, supports your goals, and gives you financial clarity.

1. Start by Knowing Your Income and Expenses

Begin by listing your total monthly income — salary, freelance work, side hustle, or rental income. Next, track all expenses — fixed (like rent, EMIs, and bills) and variable (like groceries, travel, and entertainment).

📊 Use digital tools such as Google Sheets, Money Manager, or Walnut App to track and categorize every transaction. This helps you see where your money really goes each month.

2. Categorize Your Spending

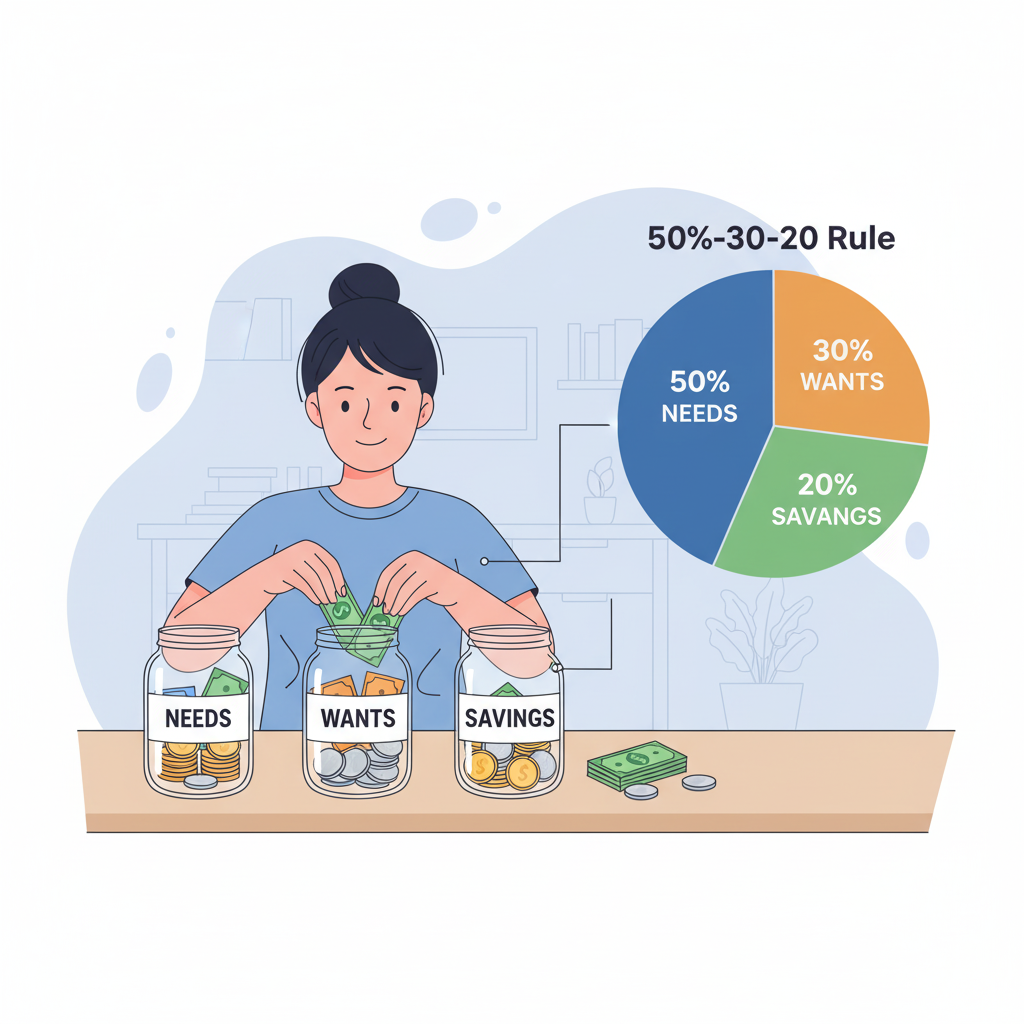

Break your expenses into categories to manage them better:

- Essential Expenses: Rent, utilities, food, healthcare.

- Lifestyle Expenses: Dining out, streaming, shopping.

- Savings & Investments: SIPs, emergency fund, insurance, retirement.

Having clear categories prevents overspending and makes saving automatic.

3. Apply the “Zero-Based Budget” Method

A zero-based budget means every rupee has a job. By the end of the month, your income minus expenses equals zero — not because you’re broke, but because every rupee is assigned (to bills, savings, or investments).

This method ensures full control and eliminates wasteful spending.

4. Automate Savings and Payments

Set up automatic transfers for savings, investments, and EMI payments. This avoids missed deadlines and builds consistency. “Set it and forget it” is the easiest way to stay disciplined without stress.

💡 Tip: Treat savings as a non-negotiable bill — not an afterthought.

5. Plan for Irregular Expenses

Expenses like car maintenance, insurance renewals, or festivals don’t occur monthly — but they can disrupt your budget if ignored. Create a sinking fund by saving small amounts each month for such upcoming costs.

6. Review and Adjust Regularly

No budget is perfect from day one. Review it monthly to see what worked and what didn’t. Adjust categories, reduce unnecessary spending, and increase savings gradually. The goal is progress, not perfection.

💡 Conclusion

A well-structured monthly budget gives you power over your finances. It shows where your money flows and helps you control it with purpose. With consistency, automation, and review, your budget will transform from a spreadsheet into a lifestyle tool — guiding you toward financial success and peace of mind.